We're Here to Help With Your Home Purchase or Refinance. Click on One of The Buttons Below or Call Us Today To Get Started.

Loan Types

Check out the different types of loans that may be available in your area

First Time Home Buyers

Tips for first time home buyers and renters to help you prepare

Downpayment

Assistance

You may qualify for available assistance based on income and location

Refinance

Use your equity to pay off debt, lower your payment, renovate and more

The Florida Legislature has funded this program again with $100 Million beginning July 1, 2024!!

Now Taking Applications for the Hometown Heroes Program!

The Florida Hometown Heroes Housing Program makes homeownership affordable for eligible community workforce.This program provides down payment and closing cost assistance to first-time, income-qualified homebuyers so they can purchase a primary residence in the community in which they work and serve. The Florida Hometown Heroes Loan Program also offers a lower first mortgage interest rate and additional special benefits new homebuyers.Program Details:*Eligible full-time workforce, employed by a Florida-based employer can receive lower than market interest rates on an FHA, VA, Conventional first mortgage, reduced upfront fees, no origination points or discount points and down payment and closing cost assistance.

*Borrowers can receive up to 5% of the first mortgage loan amount (maximum of $35,000) in down payment and closing cost assistance.

*Down payment and closing cost assistance is available in the form of a 0%, non-amortizing, 30-year deferred second mortgage. This second mortgage becomes due and payable, in full, upon sale of the property, refinancing of the first mortgage, transfer of deed or if the homeowner no longer occupies the property as his/her primary residence.

*The Florida Hometown Heroes loan is not forgivable.ENCOURAGE CONGRESS TO FUND THIS PROGRAM AGAIN FOR 2025! CONTACT YOUR CONGRESSMAN OR CONGRESSWOMAN TODAY! IN 2024, THE FUNDS WERE COMPLETELY USED IN 6 WEEKS. CHECK FOR MORE FUNDS JULY 1

Reviews

This process can be grueling, but Andrea made it practically painless, always accessible, always friendly, always had the answer I needed. Thank you.Terence Van Auken, Daytona Beach

Andrea is an amazing, competent individual of the highest integrity. She has a vast amount of knowledge about loan products in Florida, so she can get you the loan that fits your situation. Best of all, you can always trust her to do what's right for you! I highly recommend her!Matthew McGarr, Port Saint Lucie

Andrea was very helpful, knowledgeable, and quick to respond. She made the process of applying for a mortgage easy. I will be using her for any future loan needs.Brian LaCasse, Stuart

We were referred to Andrea Anicito by NextHome Treasure Coast and could not be more pleased with the service and attention we received. Everything went like clockwork. Andrea made the process simple and worked hard to be sure that everything got done in a timely manner. Very professional and personable. I am happy to give them a HUGE recommendation for anybody looking for mortgage services!Karen Luther, Palm City

Thank you so very much for working so hard on the financing for my new house! There were so many moving parts and hoops to jump through to get the loan secured. You were so amazingly patient with all my questions. I really appreciate you! Thanks again!Lauren Annen, Vero Beach

This Week's Featured Listing

Featured Video

Florida Mortgage Team

NMLS 2682443

Loan Types

FHA 203B

Not just for First Time Home Buyers! The FHA 203b is the traditional FHA purchase mortgage requiring only 3.5% down payment. It allows borrowers with lower credit scores to secure low interest rates because it is government insured. Mortgage insurance is required regardless of the down payment amounts and will be included in your payment until the loan has been paid off.

Term: 30 years

Maximum Amount: based on county limitsFHA 203K

The FHA 203k loan is designed to give you the funds needed to rehabilitate a home. Whether you just need cosmetic updating or a full home renovation, the FHA 203k can help you create the home of your dreams!

Term: 30 years

Maximum Amount: based on county limits

The FHA 203k requires you to qualify for both the purchase price of the home and any additional repairs with an additional 20% contingency reserve.VA

You earned your right to a great loan! VA loans are available with no down payment and can include the VA funding fee. You will need a certificate of eligibility and DD214 to determine if you qualify. Some funding fees are waived. No mortgage insurance is ever paid with a VA loan and interest rates are great.

Term: 30 yearsCONVENTIONAL/CONFORMING 15, 20 & 30 YEAR

Conventional and conforming loans are a great option for borrowers who have worked hard to keep their credit exceptional. Private mortgage insurance is added to any loan with less than 20% down but is removed once you reach a certain amount of equity in the home. Explore 15, 20 or 30 year terms to payoff your home sooner. Best in the industry interest rates and mortgage insurance that can be removed makes this a fantastic loan or the financially savvy borrower.

Term: up to 30 yearsBANK STATEMENT LOANS

Designed for the self employed, these loans take your deposits from 12 or 24 months as your income. No tax returns, 1099s or W2s needed.

Term: up to 40 years with interest-only or interest-bearing optionsINVESTOR LOANS

DSCR RATIO

Loans specifically designed for the investor in mind. These are for both owner and non-owner occupied homes only and are based on how much rent you will be collecting. Lenders want to see that the ratio of rent to expenses at least 1 or more.FIX & FLIP

These loans provide real estate investors with a fast and flexible way to fix and flip homes with interest only payment for up to 4 years.

Rates and down payments depend on experience.

Florida Mortgage Team

NMLS 2682443

First Time Home Buyers

First Time Home Buyers include anyone who has not owned a home in the last 3 years

--OR--

someone who has only owned a home with a spouse and is a recently displaced homemaker or single parent

Looking to purchase a home for the first time? Here are a few tips to help your loan process go quickly and smoothly!1. Make sure your credit is in good shapeExcellent Credit: 750+

Good Credit: 700-749

Fair Credit: 650-699

Poor Credit: 600-649

b.Your credit card balances should be below 20% of the limit

c. It's best to have at least 3 open and active accounts listed on your credit report2. If you're renting, pay by check

a. Having documented proof of your last 12 months of payments is often required by the lender3. Obtain proof of employment for the past 2-years

a. W2s and tax returns

b. Paystubs covering 30 days

c. Be prepared to explain any gaps in employment greater than 3 months4. Avoid large deposits or withdrawals from your bank account5. Determine a down payment amount based on your available funds. Conventional requires a minimum of 3-5% down and FHA requires a minimum of 3.5% down. Other options require more down payment. Keep in mind that closing costs are estimated at an additional 3-5% of the purchase price.6. Get prequalified using our simple process7. Research a local real estate agent or ask us for a recommendation.

Florida Mortgage Team

NMLS 2682443

Downpayment Assistance

Down Payment Assistance programs are available through both outside agencies and directly through our lenders. Call us to find out what you may qualify for.These are some of the programs available locally:0% Down Programs are now available for FHA and Conventional loans. Ask us for more information!BorrowSmart program which offers up to $1500 down payment assistance to income qualified applicants.Hometown Heroes program through FHFA which offers a no interest, no payment loan to cover up to $25,000 in down payment and closing costs. You must currently be employed in one of the qualifying jobs.Realtors Association of St. Lucie Foundation, Inc. Attainable Housing Fund

Matched savings as a grant, up to $2,500 based on availability

*Contact the Realtors Association of Palm Beaches local office for detailsCommunity Land Trust programs: These are city based programs that allow you to purchase a home with a substantial grant that will pay up to $100,000 for the land. The home is purchased on a land-lease program. Contact your local Community Land Trust for details.Home Purchase Assistance Program (SHIP/HOME) Low Income or Very Low Income

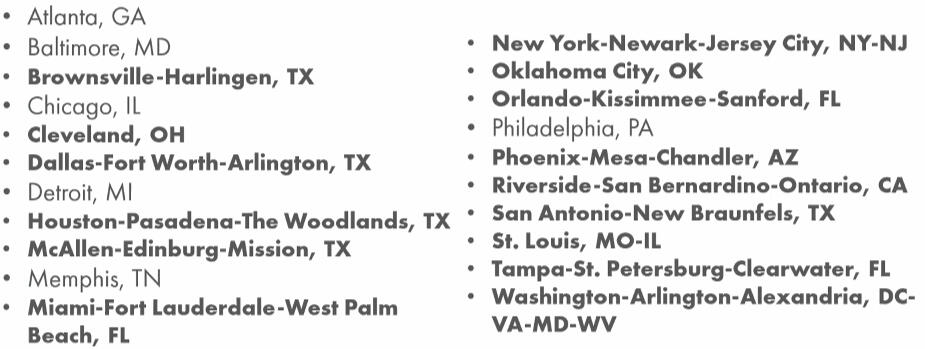

Maximum Amount: Up to $40,000 in assistance based on availability. Contact the SHIP department for the county that you're shopping for a home in for details.Through our partner relationships, we have up to $5000 is available in down payment assistance for first time homebuyers moving from these areas:

Florida Mortgage Team

NMLS 2682443

Refinance

Refinancing is the process of obtaining a new mortgage in an effort to reduce monthly payments, lower your interest rates, take cash out of your home for large purchases, or change mortgage companies. Most people refinance when they have equity on their home, which is the difference between the amount owed to the mortgage company and the worth of the home. You DO NOT need to have a current mortgage on your home to refinance. You should be on title for at least 6 months before applying for a refinance.One of the main advantages of refinancing regardless of equity is reducing an interest rate. Often, as people work through their careers and continue to make more money they are able to pay all their bills on time and thus increase their credit score. With this increase in credit comes the ability to procure loans at lower rates, and therefore many people refinance with their mortgage companies for this reason. A lower interest rate can have a profound effect on monthly payments, potentially saving you hundreds of dollars a year.Give us a call for a free quote or apply just below here.

Florida Mortgage Team

NMLS 2682443

About Us

At Florida Mortgage Team, we have a people-first mindset and are committed to helping your family find the right mortgage. We are located in Fort Pierce, Florida and offer loans for purchasing, refinancing, and investing in St. Lucie, Indian River, Okeechobee and Martin County, Florida. We understand that buying a home is a big decision and so is choosing the right mortgage broker. Our team has the knowledge and experience necessary to help guide you in the different types of loans available to you so you can make an informed decision on how to make the next step in your life. We make the process of securing a home loan simple and straightforward by offering you the latest in financial tools that enable you to make informed decisions.

Andrea Anicito, Branch Manager

NMLS 1022734

Andrea Anicito is a local mortgage broker and realtor who lives, works and serves in St. Lucie County. She has 3 children and is married to Nick. In her spare time, she enjoys spending time with family, camping, exploring new cities, riding horses and reading.

She has operated her own mortgage brokerage for more than 15 years and has over 18 years of experience helping people just like you find the perfect mortgage that works for them. Andrea is a Certified Military Relocation Expert. She served as the Women's Council of Realtors Florida Events Chair, Women's Council of Realtors Stuart-Martin Network First Vice President, on the City of Fort Pierce Historic Preservation Board, Realtors of Palm Beaches, Broward and St Lucie as a TC Regional Board Director. She currently serves on the RWorld Government Affairs committee, Florida Realtors Board of Directors, National Association of Realtors Conventional Finance Committee and St Lucie County Affordable Housing Advisory Committee. She is a member of Florida Association of Mortgage Professionals, National Association of Mortgage Bankers, Treasure Coast Opportunity Network. Andrea is an active member of the Fort Pierce Downtown Business Alliance and seeks to volunteer at many opportunities.

Ready to Get Prequalified?

To get the pre-qualification process started, please click the [Get Started!] button below. It will allow you to apply online through our secure portal.Once your application is received, you will be able to upload your last bank statement and a recent paystub or benefit statement and your last 2 years of w2’s and 1099’s. Please keep an eye out for an email from one of our loan originators to complete the pre-qualification.Please reach out anytime. We're here to help if you have questions about getting pre-qualified or the loan process. We look forward to hearing from you soon.

Florida Mortgage Team

NMLS 2682443

Contact Us:

772-380-8893 office

772-673-6289 faxBranch Address: 11600 Appaloosa Ct,

Port St Lucie, FL 34987Corporate Address: NEXA Mortgage LLC

3100 W Ray Rd Suite 201, Chandler, AZ 85226

NMLS 1660690NEXA Mortgage LLC is an Equal Housing Lender

Please leave us a review below! Let others know how we were able to help you.

Florida Mortgage Team

NMLS 2682443